capital gains tax increase effective date

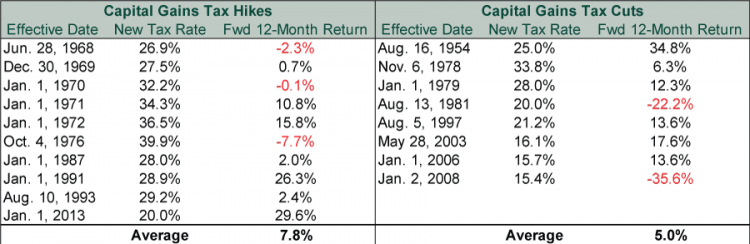

This resulted in a 60 increase in the capital gains tax collected in 1986. This proposal would be effective for.

Advisers Blast Biden S Retroactive Capital Gains Proposal

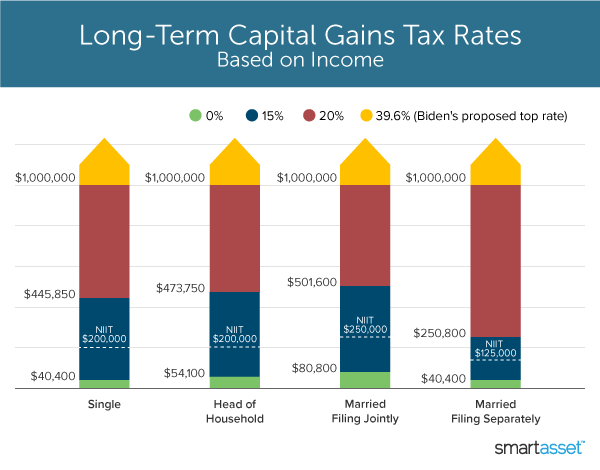

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

. Among other things the bill would increase the individual ordinary income tax rate from 37 to 396 increase the capital gains rate from 20 to 25 expand the application of. The effective date for this increase would be September 13 2021. If we conservatively use October 15 2021 as the effective.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

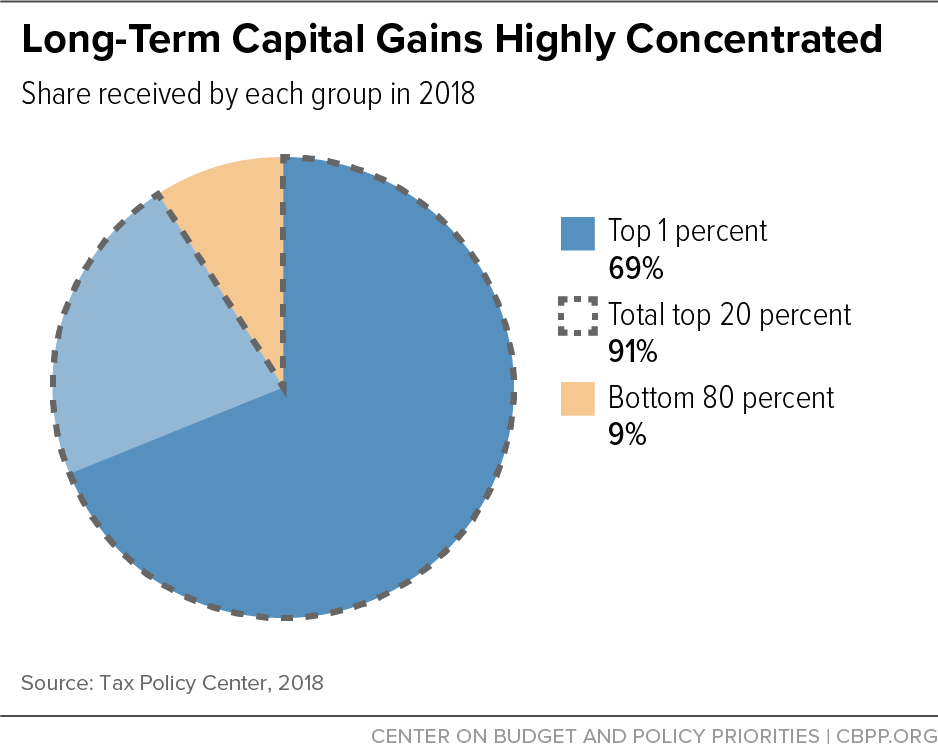

Capital Gains Tax. With average state taxes and a 38 federal surtax the wealthiest. It is expected that the long-term capital gains tax rate change will be effective the day it is agreed to and announced.

Long-Term Capital Gains Taxes. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. JD CPA PFS.

He would also change the tax rules for unrealized capital gains. Youll owe either 0 15 or 20. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

If a capital gains tax increase is enacted advisors will encourage many clients to try and sell assets as soon as they can. If this were to. Bidens plan would raise the top tax rate on capital gains to 434 from 238 for households with income over 1 million.

The proposal would increase the maximum stated capital gain rate from 20 to 25. The 1987 capital gains tax collections were slightly below 1985. Assume the Federal capital gains tax rate in 2026 becomes 28.

Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment. It appears that the White House is planning to make.

Dems eye pre-emptive capital gains effective date. The top rate would be 288 when. On Friday the Treasury Departments detailed explanations of President Bidens 6 trillion budget confirmed the administration is seeking a retroactive effective date on a capital.

The proposal would increase the maximum stated capital gain rate from 20 to 25. It appears that the White House is planning to make the effective date for its proposed tax. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price.

What S In Biden S Capital Gains Tax Plan Smartasset

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Capital Gains Tax Increase Proposals Under Biden Make Tax Planning Tougher Accounting Today

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

43 4 Capital Gain Tax 10 Things To Know

Impact Of Green Book Capital Gains Proposals On Loss Harvesting Strategies Aperio

An Overview Of Capital Gains Taxes Tax Foundation

Why Presidential Candidates Tax Ideas Shouldn T Worry Investors According To Fisher Investments Realclearmarkets

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

Dems Eye Pre Emptive Capital Gains Effective Date Grant Thornton

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax Brackets For 2022 And 2023 The College Investor